In forex trading, a lot is a unit of measurement that standardizes trade size.

The difference in the value of one currency vs another is measured in pips, which are the fourth decimal place and thus relatively small amounts.

This means that trading a single unit is not feasible, hence many platforms exist to allow users to trade these little changes in huge batches.

The value of a lot is determined by an exchange or a comparable market regulator to ensure that everyone trades the same quantity and knows how much of an asset they are trading when they initiate a position.

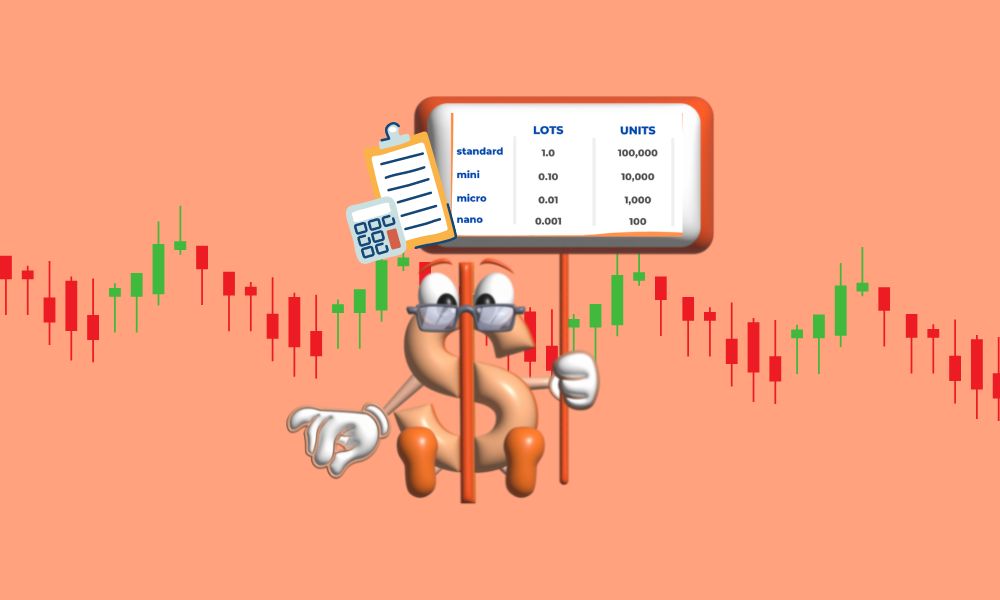

To provide traders more control over the amount of exposure they have, lots are separated into four sizes: regular, mini, micro, and nano.

So, how much is one lot in forex? It depends on whether you're trading a normal, mini, micro, or nano lot.

Forex trades are divided into these four specified units of measurement to accommodate for modest fluctuations in the value of a currency.

The following examples are all related to the currency pair EURUSD, which compares the euro (the base currency) to the dollar (the quote currency).

To put it another way, if you buy EUR/USD, you are betting that the euro will appreciate against the dollar.

If the quote price is currently $1.3000, it implies you can swap €1 for $1.3000. To put it another way, it takes $1.3000 to buy €1.

A normal lot in forex is equal to 100,000 currency units. It is the usual unit size for traders, whether they are independent or institutional.

Example:

If the EURUSD exchange rate was $2.3000, one standard lot of the base currency (EUR) would be 230,000 units.

This means that at the present rate, 230,000 units of the quote currency (USD) are required to purchase 100,000 units of EUR.

A micro forex lot is one-tenth the size of a regular lot. That is, a mini lot in forex is worth 10,000 currency units.

Because a micro lot is smaller in size than a conventional lot, the profit and loss effect is reduced.

Example:

If the EURUSD exchange rate was $3.3000, one micro lot of the base currency (EUR) would be 33,000 units.

This means that at the present rate, 33,000 units of the quote currency (USD) are required to purchase 10,000 units of EUR.

A nano forex lot is one-tenth the size of a micro lot. It is equivalent to 100 units of cash.

A one-pip movement with a micro lot corresponds to a price change of 0.01 units of the base currency you're trading, for example, €0.01 if you're trading EUR.

Example:

If the EURUSD exchange rate was $1.3000, one micro lot of the base currency (EUR) would be 130 units.

This means that at the current exchange rate, you'd need 130 units of the quote currency (USD) to buy 100 units of EUR.

In our forex trading guide, you can learn more about how to acquire currency pairs.

Assume a corporation sold chocolate boxes in two sizes: 12 and 24 chocolates.

These are common sizes that customers have grown to anticipate.

They don't usually anticipate to buy only one chocolate from the box.

It's the same with forex currency pairs. You don't just buy one unit of currency; you buy a bunch.

Lots are available in regular sizes that are generally recognized.

For example, you may purchase 100,000 lots of the base currency GBP for the currency pair GBP/USD.

That's a typical assortment. Alternatively, you might purchase a micro lot of 1000 GBP.

Normally, you won't need to determine the lot size manually because your trading platform will tell you everything you need to know.

When placing a trade, it should be apparent what alternatives are available - regular, mini, micro, and nano - as well as which lot size you're utilizing.

The size of a lot and the number of lots purchased can be used to calculate the overall size of your position.

CFDs can be traded in normal or micro lots at IG. Our platform allows you to switch between the two before submitting your order.

Consider the risk you are willing to accept while deciding on the size of your lot.

The larger the lot size, the more money you'll need to put down or leverage you'll need to utilize - and the more each pip fluctuation will be emphasized.

A one-pip movement is worth the following monetary amounts for each lot size, assuming you're trading EURUSD:

Remember that the currency value will be determined by the base currency in the currency pair you're trading.

As you can see, the smaller the lot, the less expensive a one-pip movement is. As a result, you can trade smaller lots for less money.